Пост за гости од HodlX Поднесете го вашиот пост

Wall Street is placing a lot of hope on blockchain technology to streamline asset trading. Analysts predict that $5 trillion worth of assets could be tokenized on blockchains by 2030.

However, stringent market regulations and the SEC’s reputation for being leery of cryptocurrencies could put a brake on the financial sector’s ambitions.

According to a report by asset management firm Bernstein, tokenization of assets translates into a $5 trillion opportunity over the next five years, with $2 trillion in currency and bank deposits and $3 trillion in stablecoin and CBDC tokens.

Analysts added that stablecoins and CBDC tokens, along with yield farming in decentralized markets, will compete with bank deposits as investments and savings vehicles.

The Citi Global Perspectives and Solutions 2023 report echoes this sentiment, projecting that by 2030, $4-5 trillion in tokenized digital securities will be circulating, with $1 trillion being attributed to DLT- (distributed ledger technology) based trade finance.

A total of $1.9 trillion of non-financial corporate and quasi-sovereign debt, $1.5 trillion of real estate funds, $0.7 trillion of private equity/venture capital and $0.5-$1 trillion in securities financing and collateral, as well as $1 trillion in trade finance, would be tokenized by 2030.

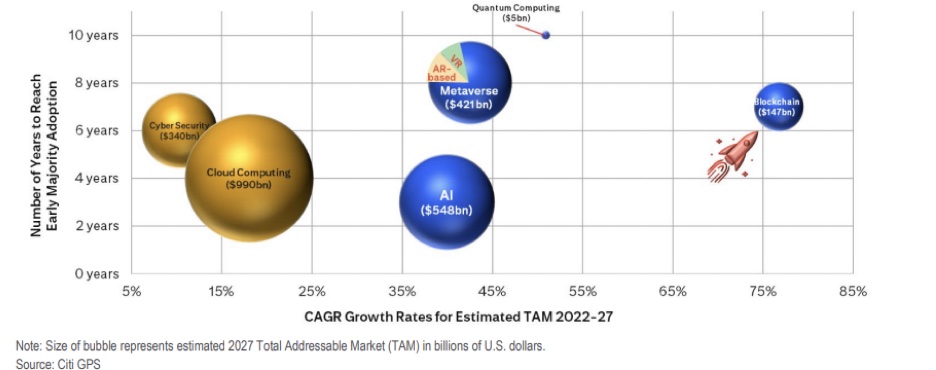

According to estimates, blockchain’s total market addressable by 2027 will be $147 billion.

What’s the deal with blockchain on Wall Street

Wall Street is restricted when it comes to investing in and trading certain financial assets like fixed income, private equity and other alternatives compared to public equities, resulting in under-allocation of such assets and a premium for assets with operational access.

Some assets might have been assumed to be unpopular among investors because they’re hard to access or expensive to manage.

Nowadays, different components of financial market infrastructure are operated through different systems, some of which were developed in the time of COBOL and Telex.

Payments have their own technology, as do asset discovery and pre-trade matching, while clearing and settlement are operated separately.

Several layers of the financial industry handle the same data, but they do it in their own isolated systems, so a lot of information has to be exchanged.

Exchange trading involves a complex communication scheme. Cross-border payments pass through multiple hoops on the correspondent banking system.

CSDs (central security depositories) and CCPs (central counterparty clearing houses) perform post-trade settlement on funds and bonds, each designed to reduce counterparty risk and settlement failures.

An industry-wide unified system would help fix this problem. Tokenization and DLT come into play here no more reconciliation, settlement failures, waiting for faxed documents or ‘originals’ to arrive by post or investment choices limited by operational difficulty in access.

In the end, a digitally native infrastructure will be globally accessible, available 24/7/365, and integrated with smart contract and DLT-enabled automation systems, which will allow for use cases that are not possible with traditional infrastructure.

Depending on the client’s investment philosophy or profile, new products could range from debt instruments that accrue daily, hourly or even minutely, to embedding real-time ESG (environmental, social and governance) monitoring.

At the level of a smart contract, the nuances of each asset can be captured.

For example, a smart contract can be programmed to automatically distribute cash tokens for corporate actions or dividends.

Hence, tokenization provides 24/7 seamless liquidity for applications such as collateral, atomic and instant settlement, rapid asset discovery, conditional payments, corporate actions controlled by smart contracts and new product features, as well as compliance enforced at the token level.

Лекции за учење

While tokenization initiatives have grown considerably in the past few years, it is equally important to examine current challenges and learn from them.

As one example, we can look at the ASX (Australian Securities Exchange).

To enhance clearing, settlement, asset registration and post-trade issuer services, ASX re-platformed its CHESS (Clearing House Electronic Sub-Register System) in 2015.

In theory, the project aimed to change the technology stack without affecting the business process.

The team stopped the project and wrote off the $165 million investment due to a series of issues, despite the technology’s quality and efficiency promise.

Among the lessons Wall Street can learn from ASX include the following.

- As the switch from a centralized legacy system to a distributed infrastructure is complex, the management governance program needs to be comprehensively revamped for all stakeholders.

- Implementing complex transformations should be phased with manageable delivery plans.

- Business workflows need to be reworked for distributed environments where latency is higher than for centralized systems and smart contracts/DLT can offer new possibilities.

- The best results can be achieved by carefully optimizing on- and off-ledger processes.

Regulatory and legal aspects

The SEC has recently taken action against several crypto companies, causing many to speculate about their intentions towards the industry.

Nevertheless, when you see someone like Larry Fink of BlackRock, the largest asset manager in the world, file to launch a Bitcoin ETF, you know he knows what’s coming.

Moreover, if you consider that Invesco, Fidelity, WisdomTree and other huge financial firms are also filing for a spot Bitcoin ETF, you realize that these companies wouldn’t do anything without knowing it would work.

And to top it all, when you hear Fed’s Jerome Powel say crypto has ‘staying power,’ you know it really does.

So, we need to learn to read the tea leaves to interpret all those signals and not get swayed by fears pushed upon us.

While the US struggles to get things done on crypto regulation, the crypto regulatory environment in other countries is quite encouraging.

With its landmark MiCA (Markets in Crypto-Assets) law an act that has been five years in the making Europe is laying down a red carpet for cryptocurrency.

In terms of legal aspects of tokenization in trade finance, the UK has recognized electronic trade documents as legal documents.

This represents an important milestone for blockchain deployment since English law governs 80% of global financial transactions.

A law enacting the Law Commission’s recommendations on electronic trade documents was signed into law on July 20, 2023.

Завршни зборови

Although blockchain technology could disrupt traditional financial markets in a significant way, and major financial institutions appear to be eager to embrace it, there are still a lot of regulatory, legal and technical hurdles to overcome before it can be widely adopted.

Even so, many experts believe that this technology will eventually become an integral part of the global financial system.

Марија Карола е извршен директор на StealthEX.io, инстант размена на криптовалути без притвор со над 1,300 наведени средства. По дипломирањето на Универзитетот во Вилнус, Марија помина речиси една деценија во крипто просторот, работејќи во маркетинг и менаџмент за различни блокчејн проекти, вклучувајќи паричници, размена и агрегатори.

Следете нè на Twitter Фејсбук Телеграм

Одрекување: Мислењата изразени во The Daily Hodl не се совети за инвестиции. Инвеститорите треба да ја направат својата претпазливост пред да направат какви било инвестиции со висок ризик во Bitcoin, cryptocurrency или дигитални средства. Ве молиме, ве советуваме дека вашите трансфери и занаети се на ваш сопствен ризик и сите загуби што може да ги направите ќе бидат ваша одговорност. Дневниот Ходл не препорачува купување или продажба на криптовалути или дигитални средства, ниту пак Дејли Ходл е советник за инвестиции. Забележете дека The Daily Hodl учествува во здружениот маркетинг.

Избрана слика: Shutterstock/Tatkhagata/Mingirov Yuriy

Source: https://dailyhodl.com/2023/09/21/wall-street-sees-blockchain-technology-as-a-game-changer/