- ETH might be prone to more sell pressure as Voyager liquidates its holdings.

- Long positions shift in favor of shorts as bearish market conditions prevail.

The ghost of 2022’s crypto contagion is yet to be exorcised. A wave of ЕТХ sell pressure might be on the way courtesy of distraught crypto firm Војаџер.

Реално или не, еве Пазарната капа на Ethereum во услови на БТК

Crypto research company Arkham recently confirmed that voyager has commenced the process of liquidating its digital assets.

The company filed for bankruptcy after a series of unfortunate market events that led to heavy losses. Initial data reveal that Voyager has slightly over 100,000 ETH in its addresses which will be liquidated to pay creditors.

Voyager is in the process of liquidating their on-chain assets.

They are currently sending 7-8 figures of crypto to Wintermute and Coinbase addresses daily.

They have over 100K ETH remaining to sell off – that’s over $150M!

Arkham will be dropping a deep-dive at 12:00 EST. pic.twitter.com/XhACb5wlxa

— Аркам (@ArkhamIntel) Март 9, 2023

The amount of ETH to be liquidated is worth over $150 million. The report further revealed that the funds will be sent to Coinbase and Wintermute addresses.

Those liquidations may translate to a large amount of sell pressure within the next few days. Such an outcome might trigger a deeper bearish move below $1,500.

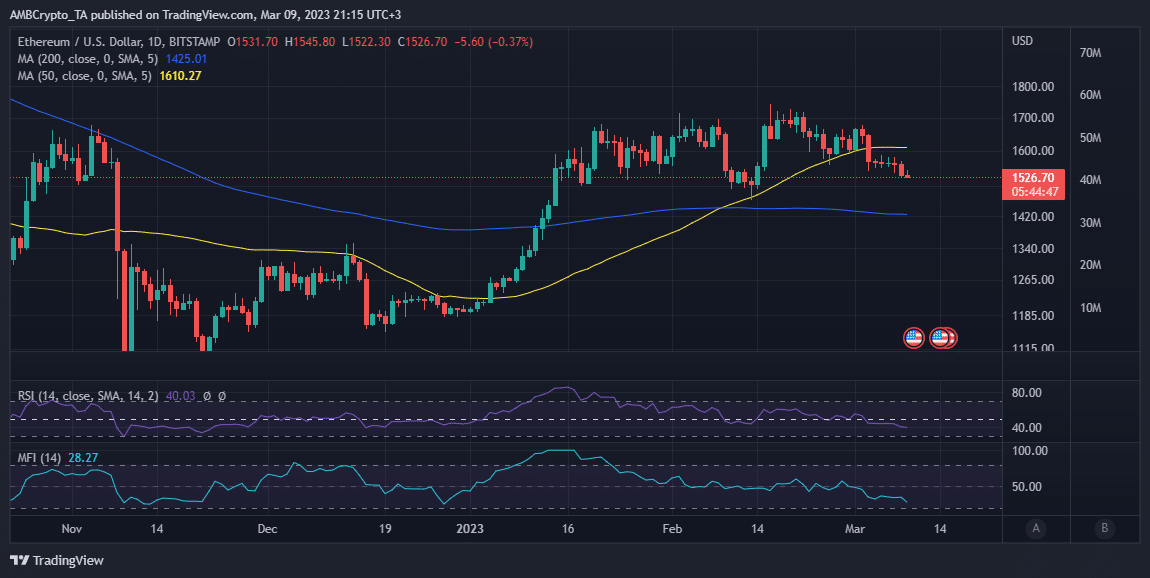

ETH bears have so far pushed the price down by roughly 12% from its February highs to its $1,527 press time price. However, the Voyager liquidations are not the only bearish concerns for bullish traders.

Bullish expectations dimmed for the last few weeks courtesy of anticipated rate hike increases. Federal Reserve chairman Jerome Powell recently reignited those bearish expectations during a recent Senate hearing. He revealed that the FED might have to increase rates to have a better chance at combatting inflation.

Дали вашето портфолио е зелено? Проверете го Калкулатор за профит на Ethereum

Are ETH derivatives traders taking advantage?

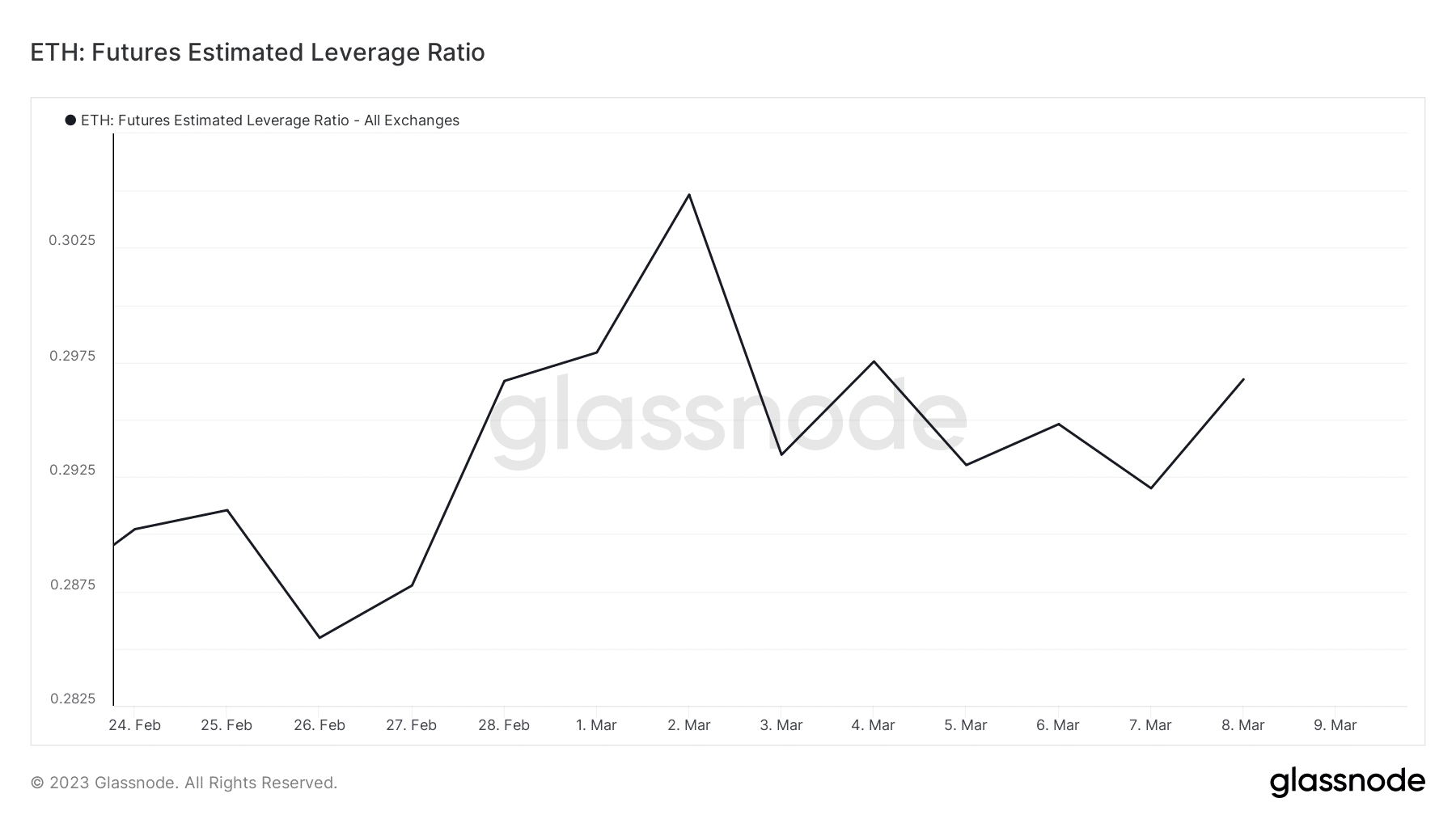

With the aforementioned problems taking center stage, shorts traders will be looking to take advantage. That is likely the case according to multiple metrics including the futures estimated leverage ratio. The latter has improved over the last two weeks as prices dropped.

The surge in the futures estimated leverage ratio is particularly evident in the last two days confirming healthy demand for leverage.

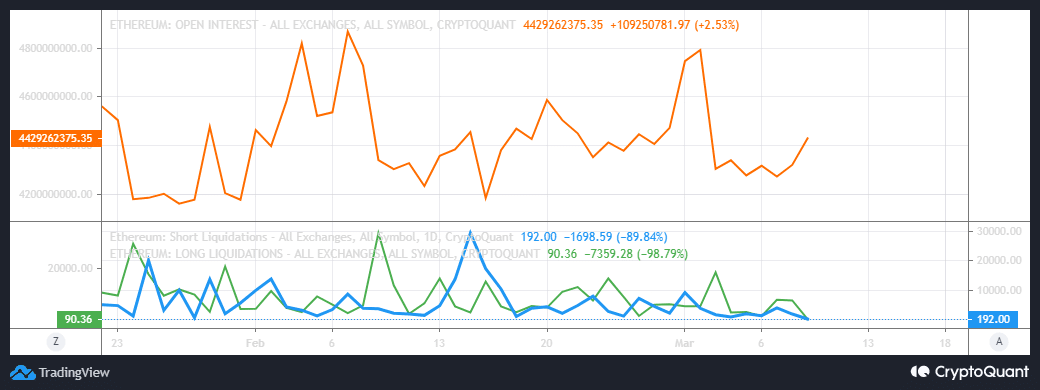

The price has been bearish during the same time. Also, ETH’s open interest metric is on the rise this week and especially in the last two days. A potential sign that there is demand for shorts.

Another noteworthy observation regarding the state of derivatives is that investors have shifted from long positions likely in favor of shorts.

The longs liquidation metric shows a drop in liquidations courtesy of the bearish market conditions.

Source: https://ambcrypto.com/ethereum-can-be-subjected-to-harsh-sell-pressure-this-week-heres-why/