The pain is piling up for equity investors after the long U.S. holiday weekend, with bond yields at levels not seen since early 2020, and oil prices tapping 2014 highs.

The pace of Federal Reserve monetary policy tightening amid the highest inflation in about 40 years, a bumpy start to the corporate earnings reporting season and pandemic uncertainties are just a few things on the worry list. Technology stocks

КОМПИС,

are set to take the biggest hit on Tuesday, as a rapid rise in short term interest rates tends to make their future cash flows less valuable.

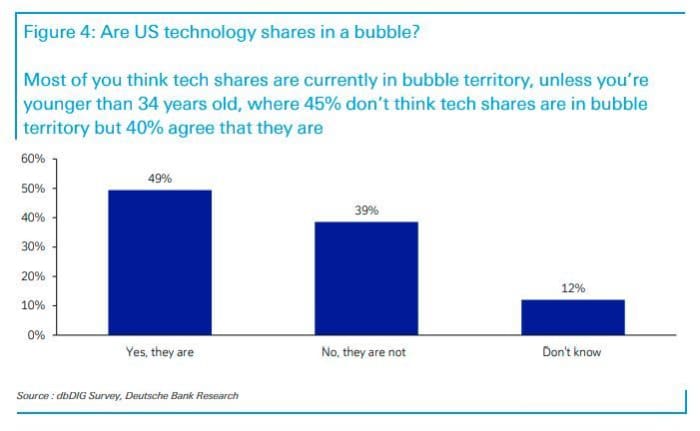

While a Deutsche Bank chart (below) reveals more tech-bubble worries, our повик на денот makes a case for one of the biggest tech stalwarts, Apple

ААПЛ,

saying the iPhone maker has an ace in the hole that few are paying attention to.

That call comes from investment adviser Wedgewood Partners, who kick off their fourth-quarter 2021 client letter with a warning about market volatility for 2022, triggered by central bankers who are about to usher in some market chaos by pulling the plug on years of cheap money. Even Chinese President Xi Jinping was heard warning the Fed not to hike interest rates at a virtual Davos on Tuesday.

However, the adviser also sees opportunities ahead as selling picks up speed, and they plan to stick to Apple, which they’ve owned for 16 years.

While Wedgewood said it couldn’t foresee the many products the company unveiled, “we did know that Apple’s vertically integrated [software and hardware] product development strategy was unique and extremely capable of creating products and experiences that customers thought worthwhile enough to spend growing amounts of time and money on,” said the adviser.

Today, that strategy remains intact, but more important Apple is commanding a key new realm, having developed over a dozen custom processors and integrated circuits, since launching its “A-series” processors. For example, one it produced in 2017 provided the iPhone X with enough power to operate FaceID 3-D algorithms, used to unlock phones and make digital payments.

“Apple has effectively created a semiconductor business that rivals and even surpasses some of the most established semiconductor-focused businesses in the industry,” said Wedgewood. “Apple continues to differentiate through vertical integration, which has been a hallmark of Apple’s long-term strategy to grow and capture superior profitability. It is difficult to predict what new products will be unveiled; however, we think this strategy should continue to serve

shareholders quite well.”

Other top positions recommended by Wedgewood include telecom group Motorola

М: ДА,

another tech stalwart Microsoft

MSFT,

and retailer Tractor Supply

TSCO,

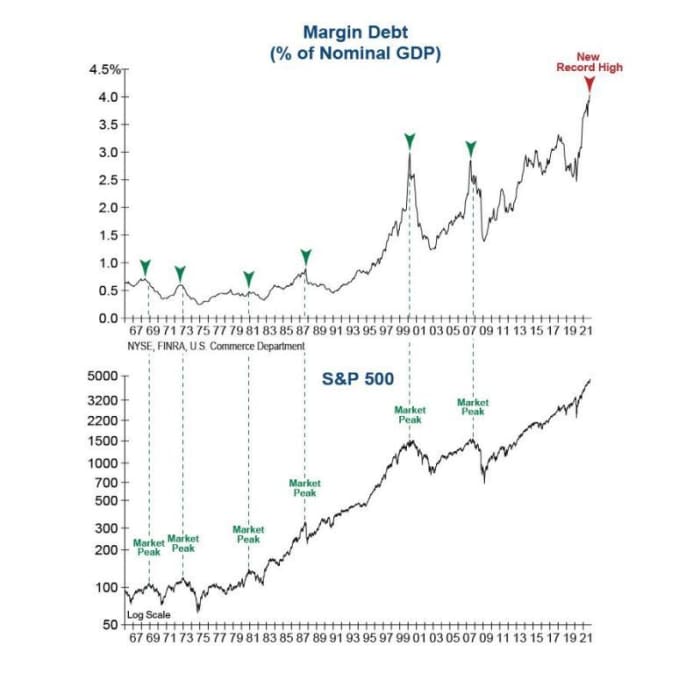

Here’s a final comment from Wedgewood about the stock storm it sees brewing. “The graphic below reminds us that when speculation reigns, markets can go far higher than what seems sober,” but when they fall “markets will repeat their long history of falling faster and further than what seems sober.”

Партнери на Wedgewood

“Long term investors should root for such downside. Such times are opportunities to improve portfolios. Our pencils are sharpened for opportunities as Mr. Market serves them up.”

Пазарите

Microsoft shares are slipping after the tech group confirmed it will buy Activision Blizzard

АТВИ,

in a $68.7 billion cash deal. The gaming group’s shares are flying, along with those of rival Electronics Arts

ЕА,

Голдман Сакс

Г.С.,

added to a disappointing batch of bank results from last week, with shares down as earnings came up short, with Charles Schwab

SCHW,

also falling on gloomy results. Kinder Morgan

КМИ,

и Алкоа

АА,

are still to come.

Airbnb shares

АБНБ,

are slumping after ratings and target cut from an analyst who sees multiple headwinds and too-few catalysts.

The New York Empire state manufacturing index for January fell well short of expectations. A National Association of Home Builders index for the same month is still ahead.

An unpublished study by an Israeli hospital showed second Pfizer

PFE,

-BioNTech

BNTX,

or Moderna

МРНК,

boosters aren’t halting omicron infections. Separately, Moderna’s CEO Stephane Bancel said his company is working on a combined flu/COVID booster, while White House chief medical advise Dr. Anthony Fauci, said it’s too soon to tell if omicron will bring us out of the pandemic.

Another study says COVID infections are turning children into fussy eaters due to parosmia disorders that distort their sense of smell. And China state media says packages from the U.S. and Canada had helped spread omicron, as Hong Kong gets ready to cull thousands of hamsters.

An airline lobby group is warning of “chaos” for U.S. air travelers due to 5G services rolling out this month, in a letter signed by big carriers, UPS

UPS-от,

и FedEx

FDX,

Larry Fink, chairman and chief executive of BlackRock

БЛК,

said investors need to know where company leaders stand on societal issues.

Retailer Walmart

СМТ,

is looking at creating its own cryptocurrency and nonfungible tokens, according to U.S. patent filings.

Пазарите

Некредитиран

Композитот Nasdaq

КОМПИС,

is sprinting ahead with losses, with the Dow

DJIA,

и S&P 500

SPX,

also lower Tuesday led by those for the Nasdaq-100

NQ00,

како приноси на обврзниците

TMUBMUSD10Y,

TMUBMUSD02Y,

surge across the curve. Oil prices

BRN00,

CL00,

are surging after Iran-backed Houthi rebels launched a deadly drone attack on a key oil facility in Abu Dhabi. Goldman Sachs also predicted Brent could top $100 a barrel in 2023, while the OPEC left its 2022 global oil-demand forecast unchanged.

Losses spread to Asian

НИК,

и европските акции

SXXP,

with a key German bund yields

TMBMKDE-10Y,

about to turn positive for the first time in three years.

Табелата

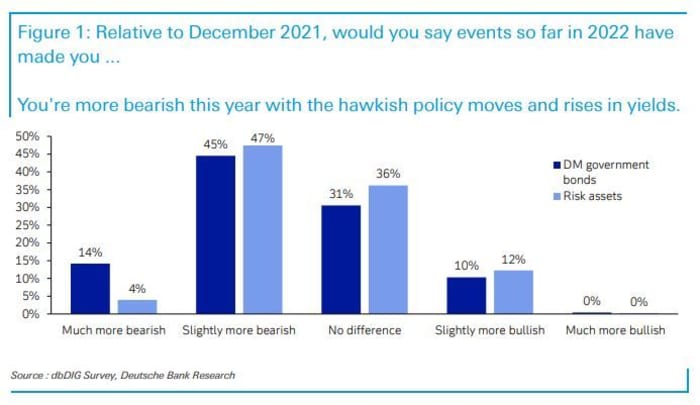

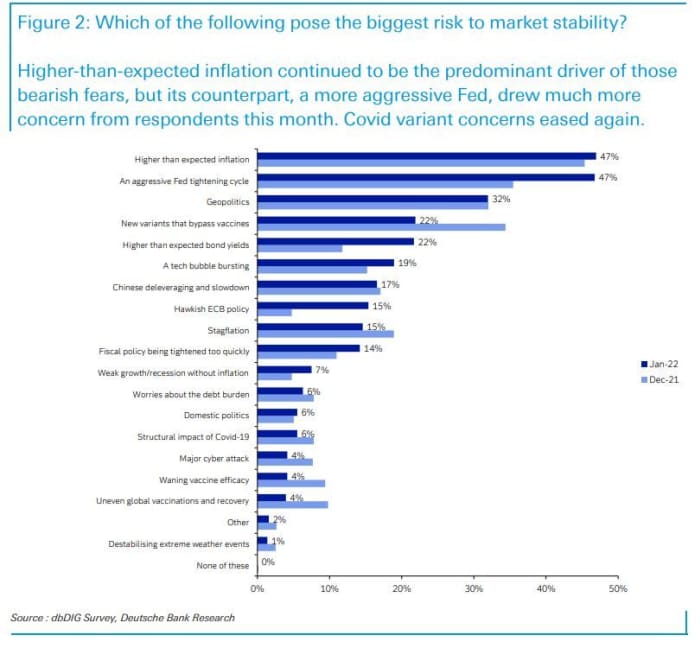

A January survey of more than 500 investors polled by Deutsche Bank shows a slightly gloomier mood. For example, they are more bearish:

Некредитиран

Many, especially those over 34, think tech shares are in a bubble:

Некредитиран

And they continue to see inflation as the biggest risk to markets, but are also fretting a more aggressive Fed:

Некредитиран

Here are the top stock tickers on MarketWatch as of 6 a.m. Eastern Time.

| Тикер | Безбедносно име |

| TSLA, | Тесла |

| ГМЕ, | GameStop |

| АМЦ, | АМЦ Забава |

| ГОЛЕМ, | Vinco Ventures |

| НИО, | NIO |

| ААПЛ, | Јаболко |

| CENN, | Групацијата Центро Електрик |

| НВДА, | Nvidia |

| БАБА, | Alibaba |

| NVAX, | Новавакс |

Случајно чита

Tulsa pastor apologizes for wiping his saliva on a man’s face during a sermon.

The high environmental cost of your beloved fish-oil pills.

Треба да знаете започнува рано и се ажурира до bвончето, но пријавете се тука за да го доставите еднаш во полето за е-пошта. Верзијата по е-пошта ќе биде испратена околу 7:30 часот источно.

Сакате повеќе за денот пред вас? Пријавете се за The Barron's Daily, утрински брифинг за инвеститорите, вклучувајќи ексклузивни коментари од писатели на Барон и MarketWatch.

Source: https://www.marketwatch.com/story/brace-for-a-volatile-2022-but-cling-to-this-tech-stalwart-when-the-storm-comes-says-investment-advisor-11642508155?siteid=yhoof2&yptr=yahoo