Одрекување: презентираните информации не претставуваат финансиски, инвестициски, трговски или други видови совети и се исклучиво мислење на писателот

- MKR’s retracement is approaching a crucial demand zone

- A retest of the demand zone could offer new buying opportunities

Произведувач [MKR], на прес-време, беше one of the market’s biggest weekly gainers, despite the overall bearish sentiment in the crypto-market. In fact, it recorded gains of 10% compared to Bitcoin’s [BTC] 4.6% depreciation over the last 7 days.

One of the main reasons for the rally could be MKR’s aggressive fee reduction and readjustment, both of which were објави towards the beginning of March.

Прочитај Maker [MKR] Цена предвидување 2023-24

MKR sliding into the demand zone – Can bulls prevail?

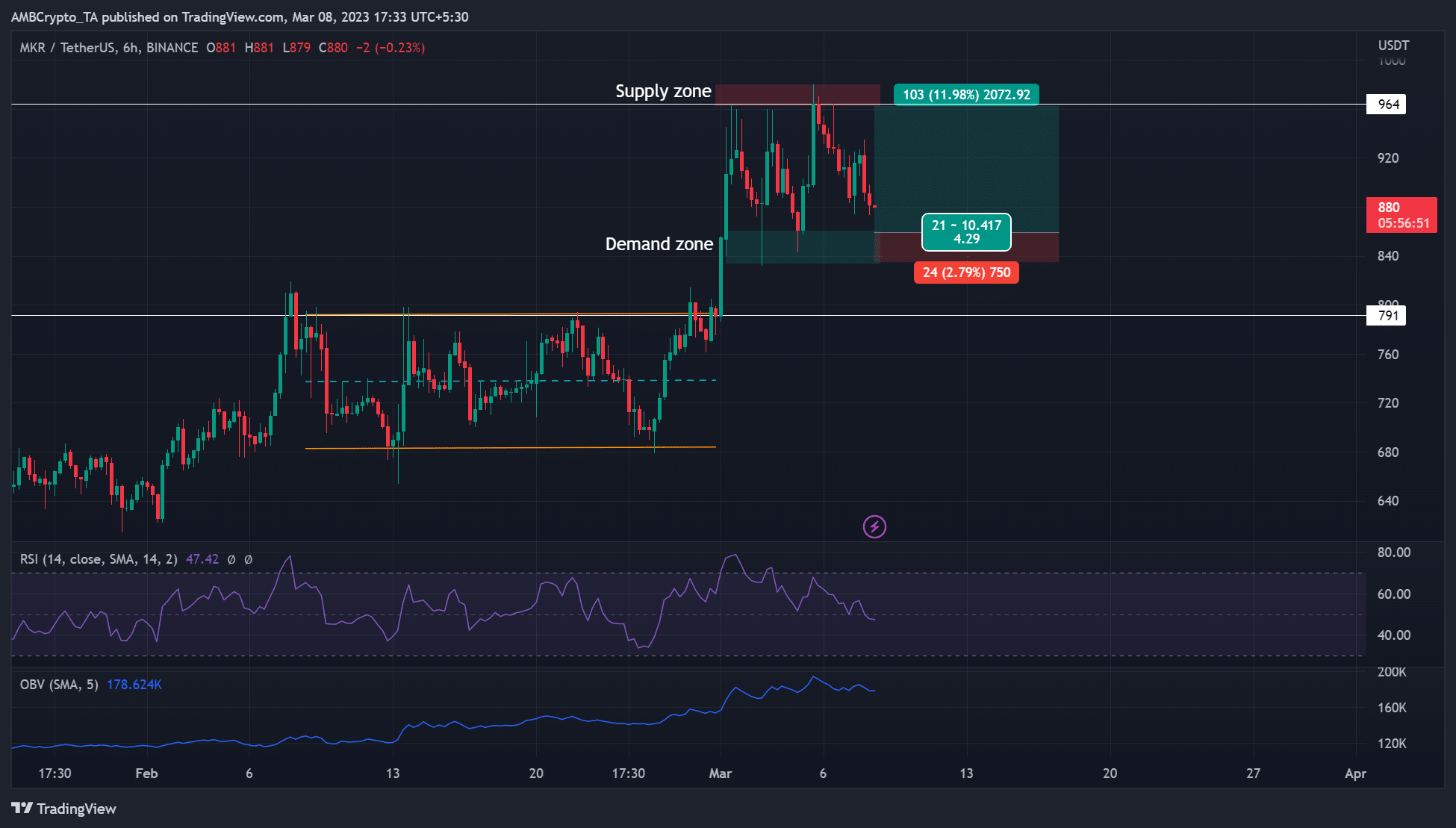

After an extended price consolidation in the $683 – $791 range in February, MKR broke above it and inflicted over 20% gains in early March. However, the $964-level has become a key sell pressure (supply zone), preventing further northbound movement. Each price rejection at the supply zone has led to a retest of the demand zone.

If the trend repeats itself, a retest of the demand zone could offer new buying opportunities in the next few hours/days. Long-term bulls could seek entry and target the sell pressure level of $964 – A potential 10% rally with an excellent risk-to-reward ratio (4.3).

A close below $833 will invalidate the bullish thesis. Such a downswing could tip bears to seek short-selling opportunities at $791 or the previous parallel channel’s (orange) mid-level of $740.

The Relative Strength Index (RSI) was below 50, which tip bears to sink MKR to the demand zone. Moreover, the OBV (On Balance Volume) registered a slight decline which could undermine strong buying pressure in the short term and offer bears more influence.

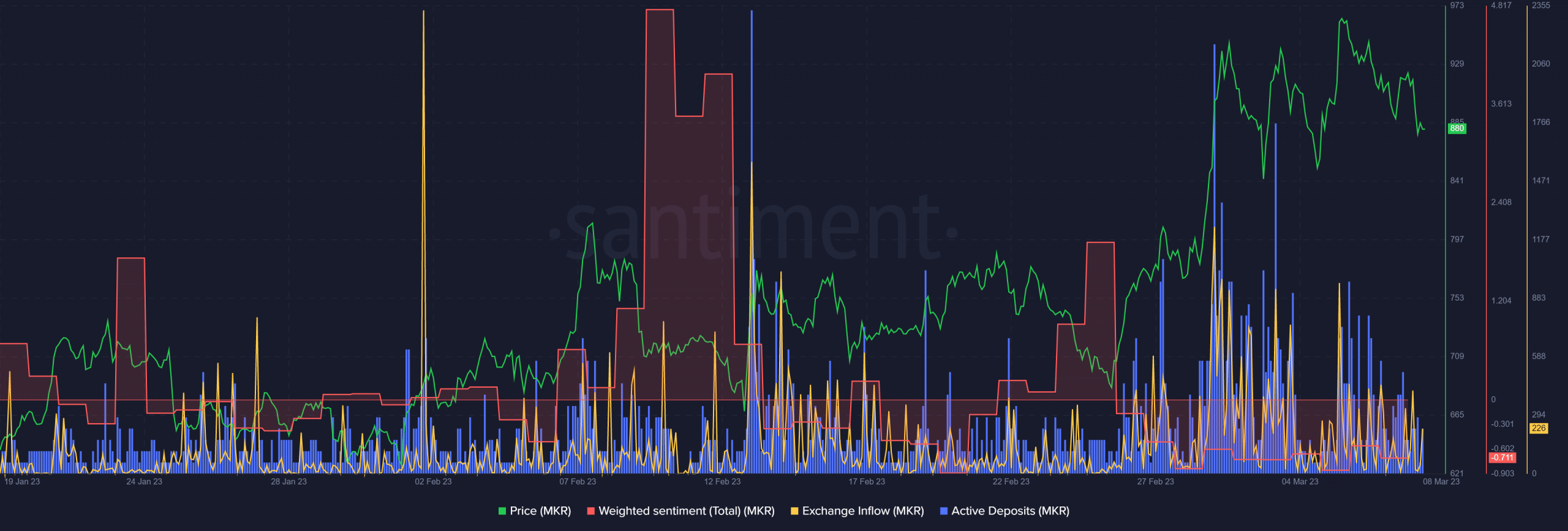

MKR recorded spikes in active deposits and exchange inflows

According to Santiment, MKR recorded spikes in exchange inflows – A sign that more tokens were moved into central exchanges for offloading. It revealed increased short-term sell pressure, which could pull MKR to the demand zone. Similarly, the spike in active deposits further reinforced the short-term sell pressure MKR recorded at the time of writing.

Дали вашето портфолио е зелено? Проверете го Калкулатор за добивка на MKR

Moreover, the negative weighted sentiment could play in the bears’ favor and push MKR to retest the demand zone ($833 – $860). Bulls could get new buying opportunities at discounted prices if the zone holds.

However, bulls’ efforts could be undermined if BTC drops below $22K. Ergo, investors should track the king coin’s price action on the charts.

Source: https://ambcrypto.com/maker-mkr-heading-towards-key-demand-zone-is-a-reversal-likely/