Renowned American investor and hedge fund manager Michael Burry has made a big bearish bet on stock markets. The move against the market suggests that his firm lacks confidence in economic recovery by wagering on a more bearish scenario.

On Aug. 14, Michael Burry’s Scion Asset Management put $1.6 billion to work betting against the stock market.

Betting on a US Recession

Michael Burry has placed bearish bets against the S&P 500 and Nasdaq 100 for the last quarter.

The investor was immortalized after his huge bet against the mid-2000s housing bubble was made into the book and movie “The Big Short.”

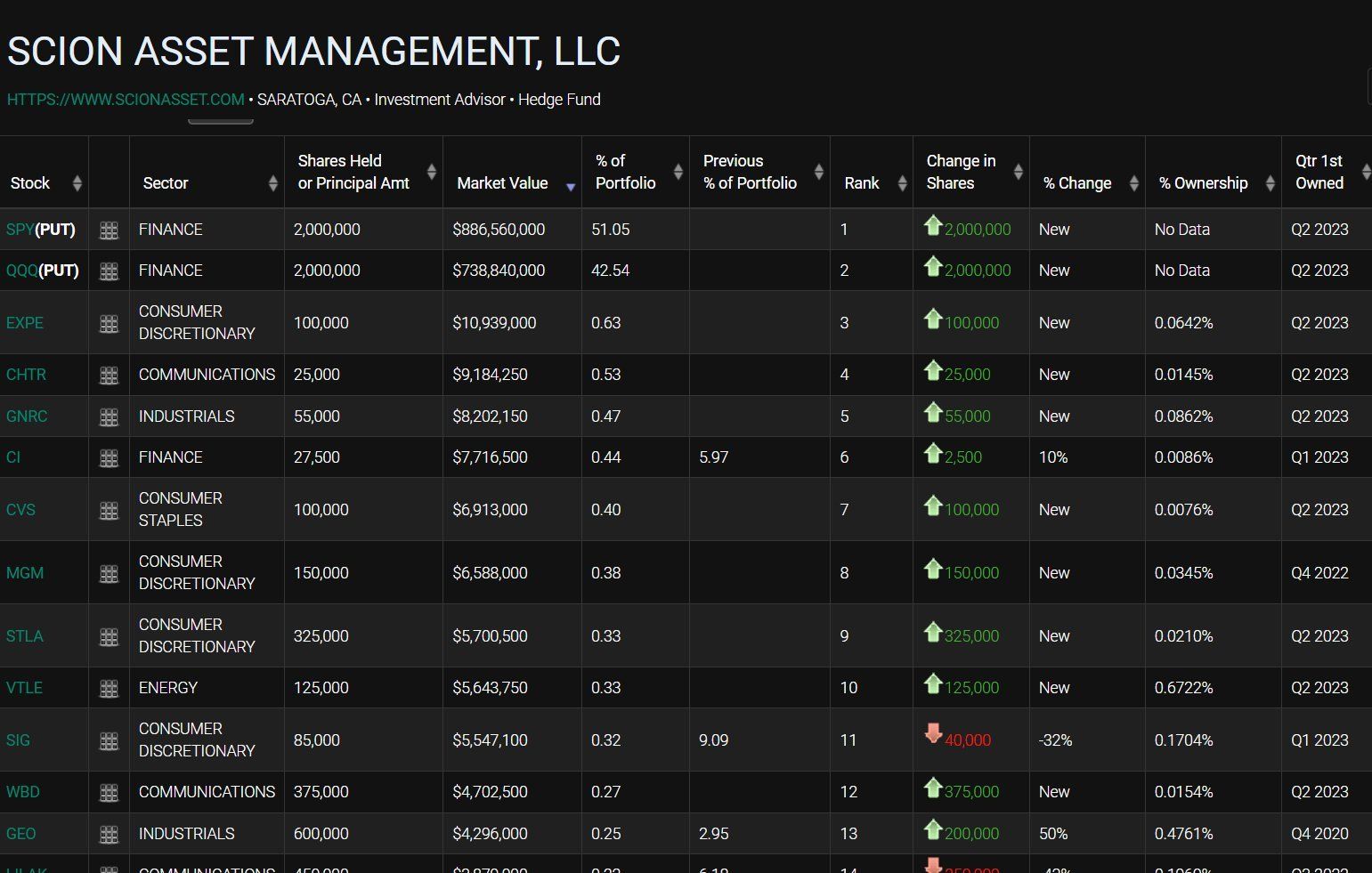

According to securities filings released on Aug. 14, Scion bought put options with a notional value of $886 million against the SPDR S&P 500 ETF Trust. The fund tracks the S&P 500, a broad market index that seeks to capture the overall performance of the large-cap US stock market.

Furthermore, he also bought $739 million in notional value put options against the Invesco QQQ Trust ETF QQQ. This fund tracks the tech-heavy Nasdaq 100 index.

Put options are derivatives contracts that give the investor the option to sell at a given price.

The $1.6 billion that Scion spent betting against the markets represents 93% of the fund’s entire portfolio. However, the Kobeissi Letter рече, “While we don’t know the price paid per contract, the total is MUCH LOWER than $1.6 billion”. This is due to the way options are reported.

Спонзорирано

Спонзорирано

Burry has also switched out his wagers on Chinese e-commerce giants and embattled banks for positions in shipping, mining, and energy companies.

Earlier this year, Michael Burry warned that the United States could slip into recession before the year was out. Furthermore, he predicted a fall in the consumer price index and a slowing in Federal Reserve rate hikes.

Пазар Outlook

Last week, chief investment officer at CIBC Private Wealth US, David Donabedian, told CNN that the economy and markets aren’t out of the woods.

“Our view all along has been that we’re likely to have a recession that would begin sometime in the second half of this year, and we actually still think that’s likely.”

A US recession would not be good news for crypto markets as there is less money to be spent on riskier assets. Markets have been in a state of lethargy for five months, though analysts are generally bullish.

Some have cited ETF approvals, an end of rate hikes, and greater adoption through new launches such as PayPal’s stablecoin as potential growth catalysts.

There has been little movement over the past few days, with total capitalization remaining planted at $1.2 trillion.

Општи услови

Во согласност со упатствата на проектот Trust, BeInCrypto е посветена на непристрасно, транспарентно известување. Оваа вест има за цел да обезбеди точни, навремени информации. Сепак, на читателите им се советува независно да ги проверат фактите и да се консултираат со професионалец пред да донесат какви било одлуки врз основа на оваа содржина.

Source: https://beincrypto.com/michael-burry-short-recession-nasdaq-sp500/